Hey there! Ever thought about what would happen if one day you came home and found your apartment flooded, or even worse, burglarized? It’s not the most cheerful thought, I know, but stick with me here. This is where renters insurance steps in, kind of like a superhero for your stuff. It’s one of those things you might not think about often, but when you need it, boy, does it make a difference!

Now, I know insurance talk can be as dry as overcooked chicken, but I promise to keep this chat light, informative, and super relevant. Whether you’re living in a cozy studio, a bustling dorm, or a spacious apartment, understanding renters insurance can be a game-changer. It’s not just about protecting your belongings; it’s about peace of mind. And who doesn’t want a bit more of that in their life?

So, let’s dive into the nitty-gritty of renters insurance together. We’ll explore what it is, why you might need it, and how it can be that safety net in an unpredictable world. Trust me, by the end of this, you’ll feel like a renters insurance guru!

What is Renters Insurance?

So, what exactly is renters insurance? Imagine it as a guardian angel for your belongings. Simply put, it’s a type of insurance policy that protects you, the renter, from a whole bunch of unexpected events.

Think about all the stuff you own – your laptop, your comfy couch, that collection of sneakers you’re super proud of. Now, what if one day something crazy happens? Maybe a pipe bursts and your apartment turns into a mini swimming pool, or a sneaky thief decides your stuff is their stuff now. Not cool, right?

Here’s where renters insurance comes in. It covers the cost of replacing or repairing your belongings if they’re damaged, destroyed, or stolen. But wait, there’s more! It’s not just about your stuff. This handy policy also covers liability, which means if someone hurts themselves tripping over your rug, you’re covered. And if you have to crash with a friend because your place is being repaired, renters insurance can help cover those costs too.

It’s like having a backup plan for life’s oops moments. And let’s be real, we all have those moments. The best part? It’s more affordable than you might think (but we’ll get into that later).

In a nutshell, renters insurance is your financial safety net, making sure that when life throws you a curveball, you’re not left out in the cold. It’s not just a policy; it’s peace of mind.

Coverage Details: What Does Renters Insurance Really Cover?

Alright, let’s get into the meat of what renters insurance actually covers. Knowing this is crucial because, let’s face it, life can be as unpredictable as a weather forecast in spring.

- Personal Property Protection: This is the heart of renters insurance. Your beloved guitar, that flat-screen TV you saved up for, your laptop full of memories (and maybe work stuff) – they’re all covered. If they’re stolen, damaged in a fire, or meet other covered disasters, your policy has got your back. It’s like a safety net for almost everything you own.

- Liability Coverage: Imagine someone comes over to your place and accidentally trips on a rug, spraining their ankle. Ouch, right? Liability coverage in your renters policy can help cover their medical bills and even legal fees if they decide to sue. It’s like having an invisible shield around you, protecting you from the financial fallout of accidents that happen in your rented space.

- Additional Living Expenses: Let’s paint a picture – there’s an unexpected fire in your building, and now you can’t stay in your apartment. Where do you go? How do you afford it? That’s where ‘Loss of Use’ coverage or additional living expenses come in. It helps pay for temporary housing and living costs if your place becomes uninhabitable due to a covered event. Think of it as your plan B for when your home sweet home needs a little fixing up.

- Electronics and More: We live in a digital age, and for many of us, our electronics are our lifelines. Renters insurance often includes coverage for these items, but there’s a catch – there’s usually a limit on how much you can claim for certain categories. It’s worth checking if you need additional coverage, especially if you have high-value items.

- Natural Disasters: This can be a bit tricky. Standard renters insurance covers some natural disasters like wildfires and lightning strikes, but not all. Big ones like floods and earthquakes usually need separate policies. It’s important to understand the ins and outs of this, especially based on where you live.

Remember, all policies have their limits and exclusions. It’s like ordering a burger – you need to know what comes with it and what’s extra. The key is understanding your policy and, if needed, beefing it up with additional coverage to suit your lifestyle.

So there you have it – a rundown of what renters insurance covers. It’s more than just a piece of paper; it’s a comprehensive plan to keep you and your belongings safe in a world full of surprises.

Common Misconceptions About Renters Insurance

Now, let’s bust some myths about renters insurance. There are a few common misconceptions floating around out there that can muddy the waters. Understanding these can help you see the real value of renters insurance.

- “My Landlord’s Insurance Will Cover Me”: This is a biggie. Many think their landlord’s insurance policy will cover their personal belongings. Unfortunately, that’s not the case. Your landlord’s policy typically only covers the building itself, not what you own inside it. It’s like assuming the umbrella your friend holds will keep you dry too – wishful, but not realistic.

- “My Stuff Isn’t Worth That Much”: You might think your belongings aren’t worth insuring, but add up the cost of your clothes, electronics, and even small appliances. It’s probably more than you realize. And replacing it all out of pocket? That could be a financial strain. Renters insurance is like having a backup wallet for those just-in-case moments.

- “Renters Insurance Is Too Expensive”: The truth is, renters insurance is generally quite affordable. For the price of a few cups of coffee a month, you can get a basic policy. It’s a small price to pay for the coverage and peace of mind it offers. Think of it as a monthly subscription to tranquility.

- “I Don’t Need It If I’m Careful”: Even if you’re the most cautious person on the planet, you can’t control everything. Accidents happen, theft happens, and disasters don’t discriminate. Renters insurance isn’t about your carefulness; it’s about being prepared for the unexpected.

- “It’s Too Complicated to Get”: This myth can be intimidating, but getting renters insurance is actually pretty straightforward. With the digital age in full swing, many companies offer online quotes and easy policy management. It’s about as complicated as ordering a pizza – a few clicks, some basic info, and you’re all set!

Understanding these misconceptions helps paint a clearer picture of why renters insurance isn’t just another bill, but a smart investment in protecting yourself and your possessions. It’s about being proactive, not reactive, when life decides to throw a curveball your way.

Assessing Your Needs: How to Determine If You Need Renters Insurance

Deciding whether you need renters insurance might feel a bit like trying to solve a puzzle. But fear not! Let’s walk through some simple steps to assess your needs and see if renters insurance is right for you:

- Take Inventory of Your Belongings: Start by making a list of your possessions and their estimated value. This includes everything from your furniture and electronics to clothes and kitchen gadgets. You might be surprised at how much it all adds up. Think of it as taking a ‘financial selfie’ of your stuff.

- Consider Your Lifestyle and Risks: Do you entertain often? Live in an area prone to certain natural disasters? Have expensive hobbies or gear? Your lifestyle can impact your risk level and the need for renters insurance. It’s like choosing the right gear for a hiking trip – you want to be prepared for the terrain.

- Understand Your Liability Risks: If someone gets injured in your rental, you could be held responsible. Renters insurance can cover these incidents, shielding you from potential legal and medical expenses. It’s like having a safety net when walking a tightrope.

- Evaluate the Cost-Benefit: Weigh the cost of a renters insurance policy against the potential cost of replacing your belongings or facing liability claims. Often, the peace of mind and financial protection offered by insurance far outweighs its cost. It’s a bit like choosing between a waterproof jacket and getting soaked in a downpour.

- Check with Your Landlord: Some landlords require renters insurance as part of the lease agreement. Even if it’s not required, it’s still worth considering for your own protection.

In essence, assessing your need for renters insurance is about understanding the value of what you own and the risks you face. It’s a personal decision, but one that can offer significant financial and emotional relief in times of trouble.

The Cost Factor: Understanding the Affordability of Renters Insurance

Let’s talk dollars and cents. One of the biggest questions people have about renters insurance is, “How much is this going to cost me?” The good news is that renters insurance is surprisingly affordable. Here’s what you need to know about the cost and how to get the most bang for your buck:

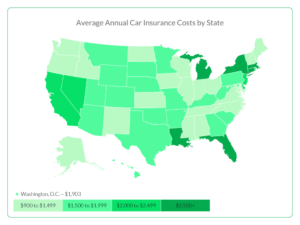

- How Premiums are Calculated: Your renters insurance premium depends on several factors, including where you live, the value of your belongings, and your chosen coverage limits and deductibles. Think of it like a personalized pizza – the final price depends on your chosen toppings.

- Average Costs: On average, renters insurance can cost as little as a few dollars a month. That’s less than your daily coffee run! For this small amount, you can get a basic policy that provides a decent level of coverage.

- Saving on Premiums: Just like shopping for any good deal, compare quotes from different insurers. Ask about discounts for things like smoke detectors, burglar alarms, or bundling with other types of insurance. It’s like hunting for hidden treasures – a little effort can lead to savings.

- Weighing Deductibles and Coverage Limits: A higher deductible typically means a lower premium, but it also means more out-of-pocket expenses when you file a claim. It’s about finding the right balance for your budget and comfort level.

- Understanding the Value: When considering the cost, think about the potential financial impact

of replacing all your belongings or facing a lawsuit without insurance. Renters insurance is a small price to pay for the protection and peace of mind it offers. It’s like buying an umbrella before a storm – a small investment that can save you from a lot of trouble.

- Long-Term Benefits: In the long run, having renters insurance can save you money. In the event of a loss, it can prevent you from dipping into your savings or going into debt to replace your belongings or cover liability claims.

Renters insurance is one of those things where the value far exceeds the cost. It’s not just another expense; it’s an affordable way to protect yourself financially. So, while it might be tempting to skip it and save a few bucks, think about the bigger picture and the financial security it can provide.

Renters Insurance in Action: Real-Life Scenarios and Final Thoughts

Before we wrap up, let’s look at a few scenarios where renters insurance can make a real difference. These examples bring to life the importance and value of having coverage:

- Imagine coming home to find your apartment burglarized. Your electronics, jewelry, and some sentimental items are gone. With renters insurance, you can file a claim to cover the cost of these stolen items, reducing the financial and emotional impact of this violation.

- Picture hosting a dinner party where a friend accidentally gets injured. Without insurance, you could be on the hook for their medical bills. Renters insurance can cover these costs, safeguarding your savings and relationships.

- Consider a scenario where a severe storm damages your rental property, making it temporarily uninhabitable. Renters insurance can help cover your additional living expenses, like hotel bills, during repairs.

These situations highlight how renters insurance can be a lifeline in times of distress. It’s not just about protecting your possessions; it’s about ensuring your financial and personal stability.

Your Questions Answered

- How does renters insurance benefit me if I don’t own many expensive items? Even if you don’t own high-value items, renters insurance covers more than just personal property. It includes liability protection and additional living expenses, which are valuable in their own right.

- Can I get renters insurance if I share my apartment? Yes, but it’s essential to understand that a standard policy typically covers only your belongings and liability. If you have roommates, they should consider getting their own policy to ensure full coverage.

- Will filing a claim increase my premiums? This depends on your insurance provider and your claim history. While filing a claim can sometimes lead to a premium increase, the financial support in times of loss often outweighs the potential cost increase.

Renters insurance is a practical, affordable way to protect yourself from the unpredictable nature of life. It offers not just financial security, but also peace of mind, knowing that you’re prepared for whatever comes your way. So, as you embark on your renting journey, give some thought to renters insurance – it might just be one of the best decisions you make for your future self.

Interested in broadening your understanding of insurance options? Here are some handpicked articles from CoverageBreeze.com that you might find helpful:

- The Quest for the Best Home Insurance: Dive deeper into finding the ideal home insurance policy that meets your needs and budget.

- Affordable Renters Insurance: Your Guide to Finding the Best Quotes: Explore our comprehensive guide for securing affordable renters insurance without compromising on coverage.

- Insurance Riders: Unveiling Hidden Benefits and Options: Learn about the additional coverage options available through insurance riders and how they can benefit you.

These articles are designed to provide you with more insights and help you make informed decisions about your insurance needs.

As an Amazon Associate we earn from qualifying purchases through some links in our articles.